Loan Amounts and Funding Terms

Loan Terms

Loan terms between 3 months and 1 year with fixed monthly payments

Loan Amounts

Loan amounts over £2,000

Eligibility Criteria

Trading Time

Have you been trading for more than 12 months?

Company Status

Are you a UK registered limited company?

Loan Purpose

Do you have a HMRC corporation tax bill?

Corporation Tax Loans

Using a business loan to pay corporation tax bills to reduce the impact of costly late payment fines is a cost effective way to utilise cash flow and resources.

Using a tax funding can spread the cost of a tax bill and improve company spending power, which in turn can allow for increased competitiveness, growth and expansion.

Helping you to maintain a healthy cash flow, corporation tax loans can provide the financial flexibility that your business needs to thrive.

How to apply for a corporation tax loan?

Quick Applications

Fill out our application form in less than 5 minutes

Dedicated Support

Your application will be allocated to your dedicated case manager

Quick Responses

Your case manager will be in touch within 4 working hours

Minimal Paperwork

They will collect all required documents to process your application

Quick Decisions

You will receive a decision within 48 hours in most circumstances

Fast Payouts

You will receive your funds within 48 hours of acceptance in most circumstances

The Benefits of Corporation Tax Loans

Flexible Terms and Borrowing Amounts

Corporation tax loans are available over 3 month to 1 years, however some businesses may be eligible for longer terms.

While there is no limit, maximum borrowing amounts are determined by the total amount of your HMRC tax bill, affordability assessments and credit checks.

All proposals are subject to full underwriting & acceptance.

Increased Spending Power

With a corporation tax loan, you can improve your financial stability by maximising resources and strategically manage cash flow.

By freeing up funds from tax payments, you can ensure you have the necessary capital to invest back into your business.

Speed of Approvals

Loan applications are relatively quick to process, with decisions in as little as 24 hours and payouts within 48 hours of acceptance.

With no need for security, decisions are made based on you meeting the lenders affordability criteria and credit checks.

The overall application process is extremely quick, provided that all the required documents are provided at the time of application.

No Risk to Assets*

When applying for loans to fund your corporation tax bill, these loans are taken on an unsecured basis. As you are not using security, your assets are not at risk in the first instance. Instead, the loan is approved on the basis of your financial health and credit rating.

*In most cases a personal guarantee is required to secure the finance to protect the lender in the event of a default.

Luckily, there are a range of personal guarantee insurance products available for businesses using unsecured finance.

Given the current economic climate and the increase in corporation tax rates, we feel that offering monthly payments over a fixed term can give you a vital cash injection.

Corporation tax loans can enable you to;

- Avoid the potentially costly HMRC penalties for late payment

- Increase cash flow to allow for spending and investment in other areas

- Spread the cost with fixed monthly payments

- Utilise your cash flow more effectively whilst avoiding costly penalties

In addition, you can also benefit from interest tax relief on the facility.

View our full range of business finance facilities here

Frequently Asked Questions

Related Resources

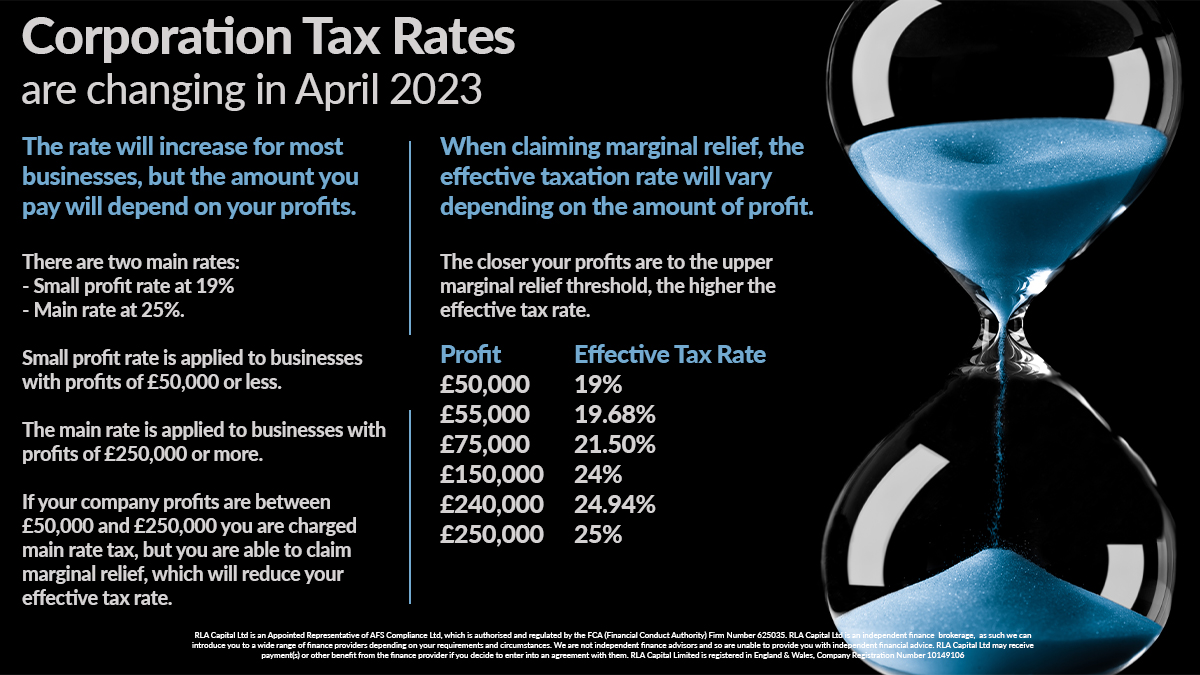

Rate of Corporation Tax in the UK

Currently, the UK Corporation Tax rate is 19%. The corporation tax rates are changing in April 2023.

The rate will increase for most businesses, but unlike previous years the amount you pay will depend on your profits.

Click to read more

What are short term business loans

A short term business loan is a type of financing that has a repayment period of less than one year.

These loans are often used by businesses who need funds to cover gaps in cash flow or unexpected expenses.

Click to read more

A guide to unsecured business finance

Unsecured business loans do not use any tangible assets, either personal or business, as collateral when applying for business finance.

When using unsecured finance, lenders look at your personal credit rating, business bank accounts and business financial reports, this is known as an affordability assessment.

Click to read more