What is the Current Rate of Corporation Tax in the UK?

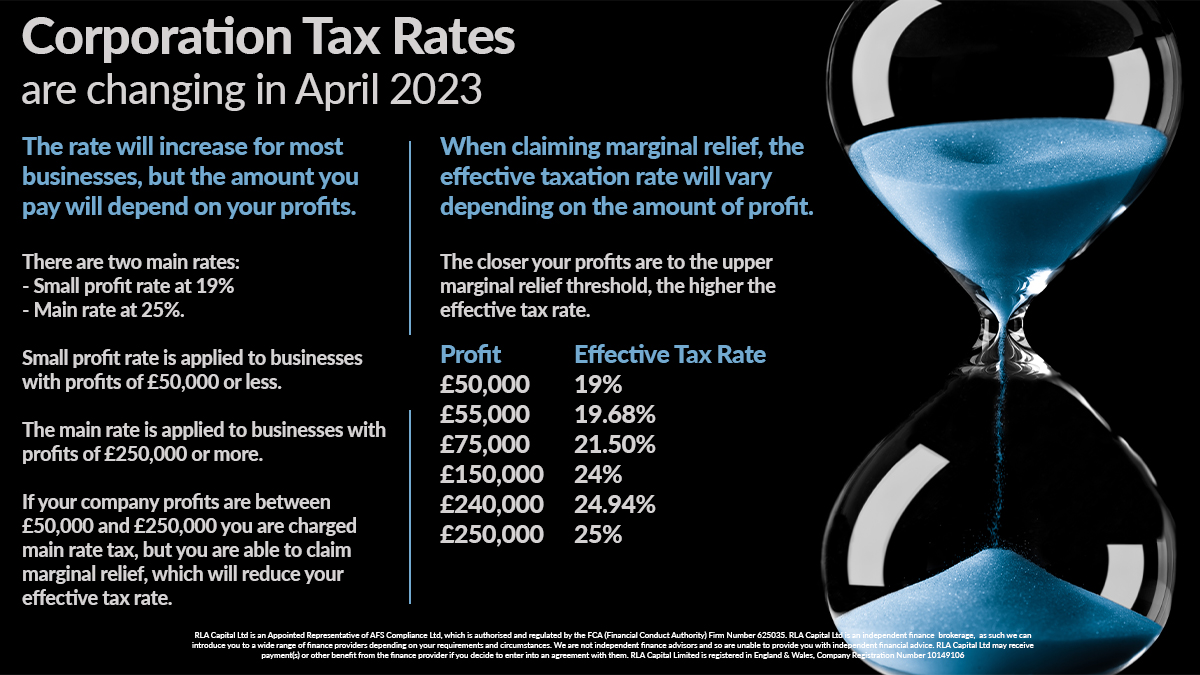

As of April 2023, the corporation tax rate has increased for most businesses, but unlike previous years the amount you pay will depend on your profits.

There are two main rates – small profit rate at 19% and main rate at 25%.

Small profit rate is applied to businesses with profits of £50,000 or less.

The main rate is applied to businesses with profits of £250,000 or more.

If your company profits are between £50,000 and £250,000 you are charged main rate tax, but you are able to claim marginal relief, which will reduce your effective tax rate.

It is worth noting that there are different rates for ring fence companies.

The rate for ring fence companies with a profit of under £50,000 is 19%.

The rate for ring fence companies with a profit of over £250,000 is 30%.

In addition to the above, profits from patents may be taxed at a lower rate of 10%.

Profits earned through the exploitation of patents can include income not only from patent royalties but also any part of trading profit, which originates from products containing patents.

What is Marginal Relief?

When claiming marginal relief, the effective taxation rate will vary depending on the amount of profit. Marginal relief provides gradual increases in the tax rate in line with the level of profit. The closer your profits are to the upper marginal relief threshold, the higher the effective tax rate.

You can use the HMRC Marginal Relief for Corporation Tax calculator to see how much marginal relief you are eligible for.

For example, for the tax year 2023 to 2024:

| Profit | Corporation Tax Liability | Marginal Relief | Corporation Tax Liability After Marginal Relief | Effective Tax Rate |

| £50,000 | £9,500 | Not Eligible for Marginal Relief | N/A | 19% |

| £55,000 | £13,750.00 | £2,925.00 | £10,825.00 | 19.68% |

| £75,000 | £18,750.00 | £2,625.00 | £16,125.00 | 21.50% |

| £150,000 | £37,500.00 | £1,500.00 | £36,000.00 | 24% |

| £240,000 | £60,000.00 | £150.00 | £59,850.00 | 24.94% |

| £250,000 | £62,500.00 | Not Eligible for Marginal Relief | N/A | 25% |

You can use the HMRC Marginal Relief for Corporation Tax calculator.

This is for illustration purposes only. For more accurate information, we advise that you speak to your accountant or financial advisor.

Who Qualifies for Corporation Tax Reliefs?

It is important you understand which reliefs that are available to you to optimise your corporation tax position.

In addition to marginal relief, companies can also use other types of reliefs, such as the R&D expenditure credit and the Research & Development allowance to reduce their tax liabilities.

Your company can also claim for losses, known as loss relief, incurred in previous years against taxable profits in the current year.

What If You Can't Afford to Pay Your Tax Bill?

If your company is struggling to pay its tax bill on time, there a number of options available to you to help you reduce the impact of late/ non-payment fees and penalties.

You can choose between requesting a time to pay arrangement (TTP) – if you are eligible – or you can opt for a corporation tax loan.

Time to Pay Agreements

With TTP, you can arrange a payment plan with HMRC to pay what you owe over the course of the year. You will incur interest and fees when using a TTP. If you missed any payments, then the arrangement will be cancelled and you will have to pay what you own in full.

PLEASE NOTE that Time To Pay arrangements are solely at the discretion of HMRC and you should contact HMRC as soon as possible if you need to request one. Alternatively, you can look for a Corportation or Income Tax Loan.

TTP can be a good option if you have not had one before, the business can afford the payments and you are sure you can meet the conditions of the agreement.

If you are already in a TTP, maybe for VAT, then you will not be eligible for another TTP agreement. In addition, if you use TTP regularly, then HMRC are unlikely to agree further TTP arrangements.

Corporation Tax Loans

If you are not eligible for a TTP, or do not want to owe HMRC any money, then using finance can be a good option.

We can offer specially tailored corporation and income tax loans designed to help your company manage it’s payments more effectively.

These loans are generally available with 3 months to 1 year terms (in certain circumstances terms can be longer).

With corporation tax loans you can finance your tax bill up to 1 month after you have paid it and up to 1 month after it was due, generally.

Using finance can help your company:

- Avoid the potentially costly HMRC penalties for late payment

- Increase cash flow to allow for spending and investment in other areas

- Spreading the cost with fixed monthly payments

- Utilise your cash flow more effectively whilst avoiding costly penalties

Whilst RLA Capital cannot offer financial advice, we can provide various business loans to assist with cash flow. RLA Capital would recommend speaking with your accountant if you are experiencing cash flow problems.