How To Fund Your New Business Venture

Starting a new business can be complex and time consuming. Having enough cash get the ball rolling will always be extremely important. There are many sources of funding available to you but knowing which one is the best fit for you can be difficult.

Before you start funding your new business venture, make sure you have thought about what type of business structure you would like to adopt, as this can influence which is the best type of funding for your business.

The main types of business structure are sole trader, partnership or limited company.

As a sole trader it can be easier to set up a business, but you will normally need to use your personal assets as security for a loan.

If you are registering as a limited company, you are less likely to have to use your personal assets as security, but it can be more difficult to get a business loan until you have been trading for more than 12 months. However, in almost all cases you will need to provide a Personal Guarantee and Indemnity.

When looking to apply for finance, the first step is to put together a detailed business plan as this will help you identify how much money you need and in what time frame.

It will also give potential lenders an insight into how well prepared you are and how likely it is that your business idea will succeed.

Your business plan should document a well thought out plan of action, in a way that is easy for lenders to gain a full picture of your business idea and how you are planning to be a success.

You can find ready to use templates from a wide range of websites.

Most business plans contain:

- Overview of your business

- Aims and Objectives

- Executive Summary

- Your strategy

- How you will you succeed

- Research, plan, execute

- SWOT analysis [find out more]

- Market information

- Opportunities and Risks

- Location

- Competitors

- PEST analysis [find out more]

- Team Members

- Names

- Roles

- Responsibilities

- Marketing Plan

- Operational Plan

- Financial forecasts including;

- Profit and Loss forecast

- Balance Sheet Forecast

You may benefit from carrying out a SWOT (strengths, weaknesses, opportunities and threats) analysis to gain a clearer picture of the market you will be operating in and your new businesses capabilities of catering for that market.

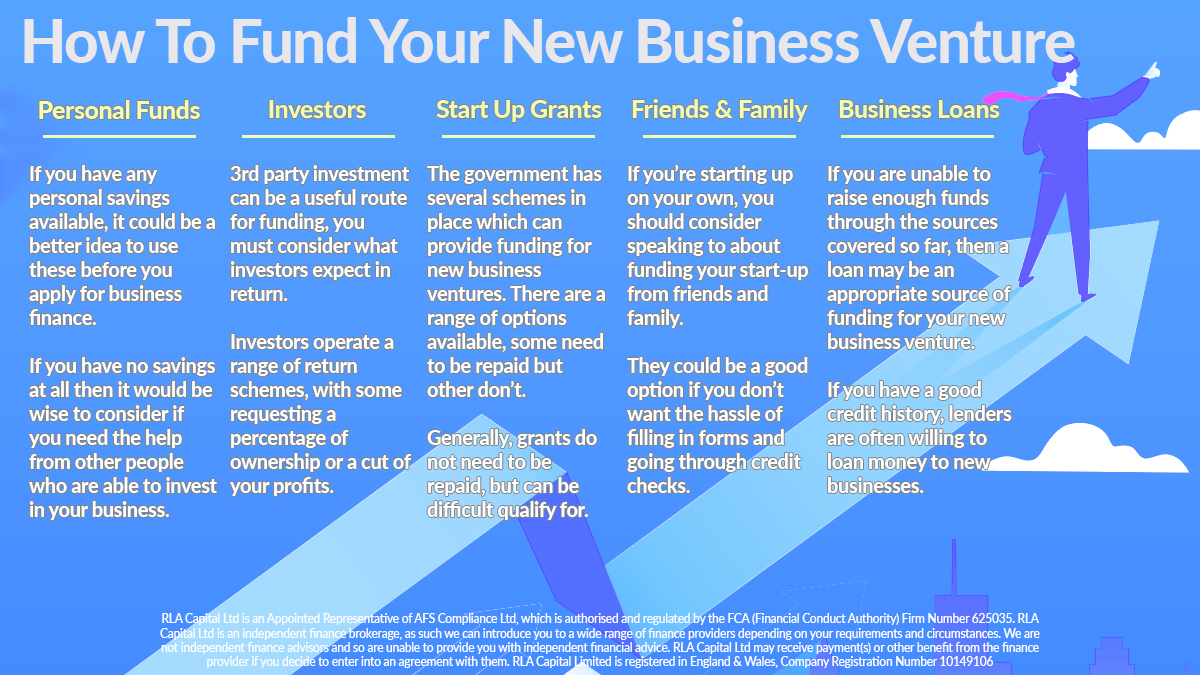

Sources of Funding

The most common sources of finance are:

- Personal Funds

- Investors

- Crowd Funding

- Friends and Family

- Start Up Grants

- Business Loans

Personal Funds

If you have any personal savings available, it could be a better idea to use these before you apply for business finance.

This is because lenders will want to see that you have put some of your own finances at risk to make sure that you have a real interest in the success of your own business.

If you have no savings at all then it would be wise to consider if you need the help from other people who are able to invest in your business.

Investors

3rd party investment can be a useful route for funding, you must consider what investors expect in return. Investors operate a range of return schemes, with some requesting a percentage of ownership or a cut of your profits.

When deciding if investors fit into your new venture, you must think about what you wish to achieve from your business and how much you want to earn.

Will parting with a percentage of ownership or profits suit your long term plan?

Crowd Funding

Crowd funding sites are often seen as an alternative to traditional bank loans, as well as being a good way to gauge interest in your product or service. Many crowd funding campaigns are created on sites such as Kickstarter, Indiegogo, GoFundMe and Crowdfunder.

They are used primarily by start-ups and new businesses looking for additional capital to get their products off the ground.

Crowd funding is especially useful if you are raising smaller amounts of money, as it allows you to tap into a large pool of potential investors without having to rely on traditional bank financing.

You can raise money from a large group of people by offering them a share in the business, a product or sometimes something as simple as a “shout out” depending on how much they invest or contribute.

The amount of money you receive depends on how many backers you have.

Friends and Family

If you’re starting up on your own, you should consider speaking to about funding your start-up from friends and family.

They could be a good option if you don’t want the hassle of filling in forms and going through credit checks.

However, there are some things to bear in mind.

While your family and friends may not charge interest, they will still expect their money back at some point.

If the relationship breaks down, it can lead to serious problems. You might even end up losing friends or family members over money issues.

It is worth having a written contract that all parties have agreed to, to reduce the possibility of disagreements further down the line.

Start Up Grants

The government has several schemes in place which can provide funding for new business ventures. There are a range of options available, some need to be repaid but other don’t.

Generally, grants do not need to be repaid, but can be difficult qualify for as they have very specific eligibility criteria.

If you do not meet the eligibility criteria for any of the grants, there are also a range of other sources of business loans that you may be eligible for.

You can use the business finance finder (https://www.gov.uk/business-finance-support ) to find the most suitable option for you and your business type.

Business Loans

If you are unable to raise enough funds through the sources covered so far, then a loan may be an appropriate source of funding for your new business venture.

If you have a good credit history, lenders are often willing to loan money to new businesses. The amount you can borrow will depend on factors such as your age and how long you've been trading, credit scoring and other financial information.

A key point to consider is the overall cost of the loan. Interest rates, fees and other costs will be added to the amount you borrow.

You must make sure you can afford the repayments. If your business fails, you could still find yourself liable for payment.

Last words…. Whichever route you take, proper research and planning ensures that you get the most suitable and cost effective funding to make your company a success.

There are many things to consider when starting a new business and it is important to ensure you keep on top of your workload and finances to make sure that you are one step ahead of the competition.

Whilst RLA Capital cannot offer financial advice, we can provide various quick business loans to assist with cash flow. RLA Capital would recommend speaking with your accountant if you are experiencing cash flow problems.