Facilities

Acquisition and Deposit Funding

Asset Finance

Bridging Finance

Business Development Loans

Case Acquisition Funding

Commercial Mortgages

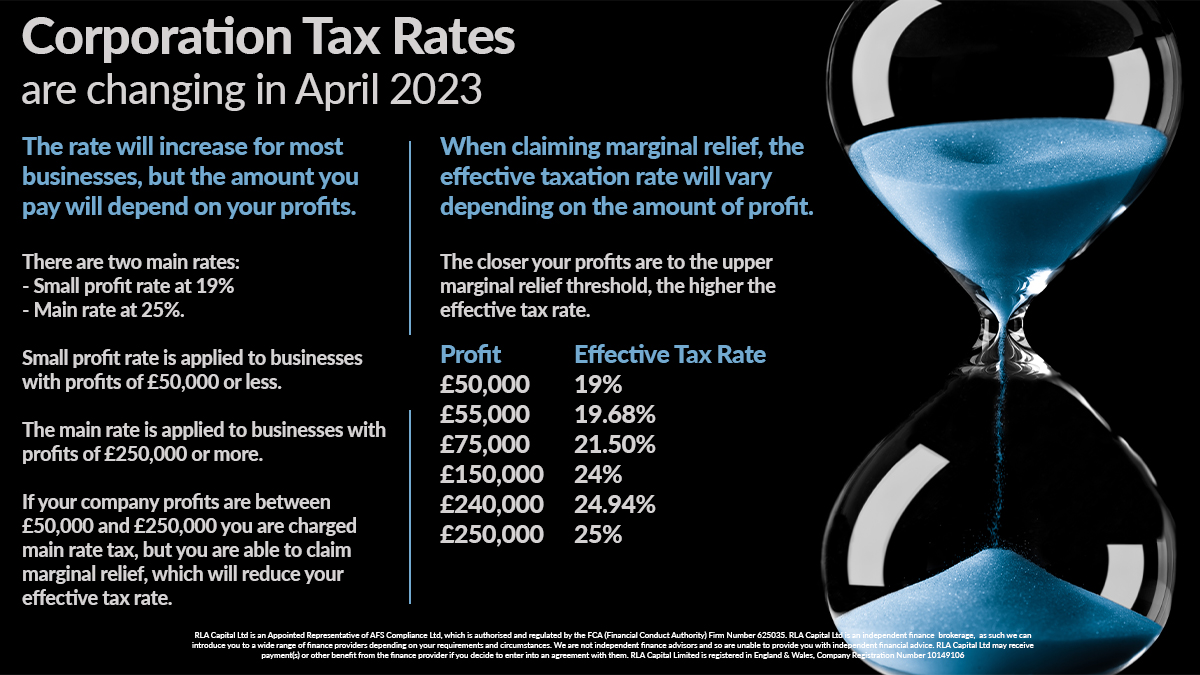

Corporation Tax